nebraska sales tax rate finder

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location. ArcGIS Web Application - Nebraska.

Maximum Local Sales Tax.

. Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 45. Wayfair Inc affect Nebraska. Maximum Possible Sales Tax.

Notice July 2 2018 If you have a retail location in Nebraska that sells cigarettes andor roll-your-own tobacco products click one of the following for important information. The calculator will show you the total sales tax amount as well as the county city. Nebraska Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax.

Also effective October 1 2022 the following cities. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. Waste Reduction and Recycling Fee.

30 rows The state sales tax rate in Nebraska is 5500. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

Sales Tax Data How to Request Sales Tax Return Information Municipal Government Request for Tax Return Information Form 8796-AL Instructions for County Treasurers. Combined with the state sales tax the highest sales tax rate in Nebraska is 8 in the city of Beatrice. Click here for a larger sales tax map or here for a sales tax table.

FilePay Your Return. The County sales tax rate is. Nebraska State Sales Tax.

77-27142 through 77-27148 Local Option Revenue Act Local Sales and Use Tax Information What Happens After the Election. Depending on local municipalities the total tax rate can be as high as 75. Department of Revenue Sales Tax Rate Finder.

Nebraska sales tax details. The Nebraska state sales and use tax rate is 55 055. The Nebraska state sales and use tax rate is 55 055.

Nebraska sales tax rate finder. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. The Nebraska sales tax rate is currently.

The Nebraska state sales and use tax rate is 55 055. Average Local State Sales Tax. 536 rows Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up to 2There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825.

Nebraska has a state sales and use tax rate of 55. Did South Dakota v. Groceries are exempt from the Nebraska sales tax.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The Nebraska NE state sales tax rate is currently 55. Nebraska has 149 special sales tax jurisdictions with local sales taxes in addition to the state.

Nebraska is a destination-based sales tax state. You can look up your local sales tax rate with TaxJars Sales. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions.

Sales and Use Taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The state sales tax rate in Nebraska is 55 but you can customize this table as needed.

Groceries are exempt from the Nebraska sales tax. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

The Omaha sales tax rate is. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. What is the sales tax rate in Omaha Nebraska.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This is the total of state county and city sales tax rates.

There are a total of 334 local tax jurisdictions across the state collecting an average local tax of 0825. The Nebraska state sales and use tax rate is 55 055. Local Sales Tax Regulations Title 316 Chapter 9 Neb.

The base state sales tax rate in Nebraska is 55. Sales Tax Rate Finder. Select the Nebraska city from the list of popular cities below to.

Nebraska has recent rate changes Thu Jul 01 2021. Combined with the state sales tax the highest sales tax rate in Nebraska is 8 in the. Find your Nebraska combined state and local tax rate.

With local taxes the total sales tax rate is between 5500 and 8000. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Free Sales Tax Calculator Small Business Tax Irs Taxes Business Tax

Nebraska Sales Tax Small Business Guide Truic

Sales Tax By State Is Saas Taxable Taxjar

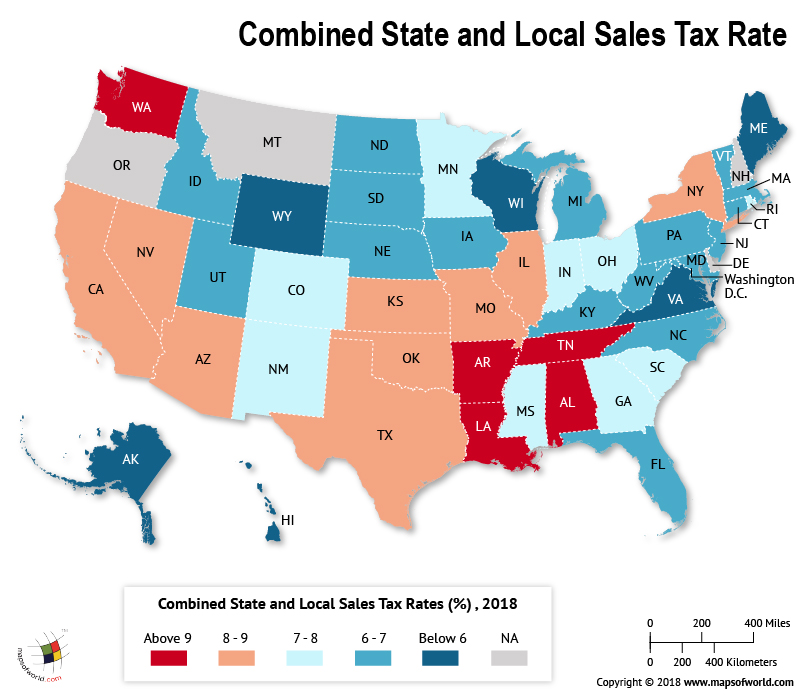

States With Highest And Lowest Sales Tax Rates

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

New Jersey Nj Tax Rate H R Block

How To Calculate Sales Tax For Your Online Store

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price